By Xie Fang

Kweichou Moutai Co. Ltd. (600519), China’s most renowned liquor producer whose stocks are included in the Morgan Stanley Capital International (MSCI) Emerging Markets Index, released its audited semi-annual financial statements on Thursday, showing a substantial profit growth over the first half of 2018.

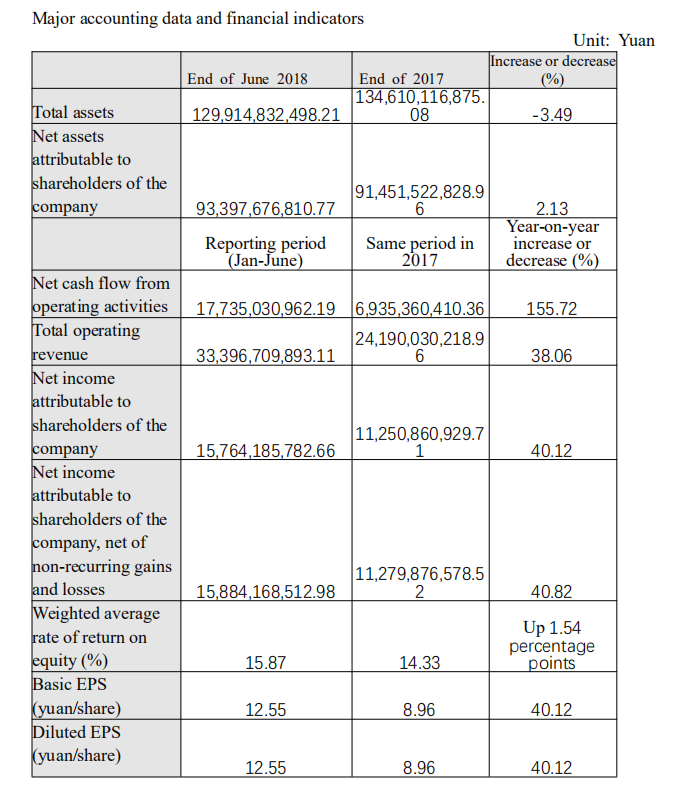

According to the statements, the company generated a total of RMB 33.39 billion in operating revenue, a year-on-year increase of 38.06 percent. Its net profit also rose by up to 40.82 percent from a year earlier to reach more than RMB 15.88 billion by the end of the reporting period.

What’s more, the company’s excellent business performance also led to a 2.13 percent increase in its net assets during the reporting period which had hit RMB 129.91 billion by the end of June.

Beyond that, the company also presented an enhanced profitability during the first two quarters of this year, with its weighted average rate of return on equity climbing 1.54 percentage points to RMB 15.87 and its basic earnings per share (EPS) rising by 40.12 percent to RMB 12.55.

The company attributed its robust profit growth to a rise in its sales volume and a price spike for its major liquor products as well. Around the end of 2017, the company raised the selling price for its product from RMB 819 to RMB 969, which marked its first price adjustment in five years.