It’s been less than two months since the 2019 novel coronavirus (COVID19) was first reported in China, and a recurring question we hear from investors is: ‘How might gold react to an epidemic like this?’

What we know from SARS

The 2003 SARS epidemic started in late 2002 in southern China but developed primarily between late March and early July 2003.1 While COVID19 is already evolving differently from the SARS epidemic, it provides the most applicable – even if imperfect – comparison available to understand how COVID19 may affect the gold market. With the qualification, of course, that both the Chinese economy and the gold market were much smaller and looked very different in 2003 than they do today, as we discuss below.

Chinese jewellery demand

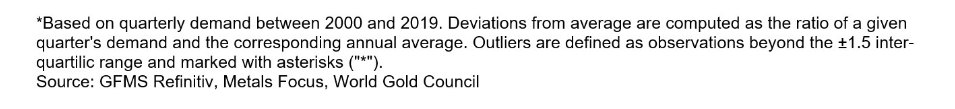

Chinese jewellery demand is quite seasonal (Chart 1): the first and fourth quarters are traditionally strong while the second quarter is generally weak.2 However, even after adjusting for this seasonal pattern, Chinese jewellery consumption contracted more than expected during the 2003 epidemic – roughly by an additional 10% to 15%.3 In the main, this effect was transient as gold demand rebounded fairly quickly and, by the second half of the year, was back in line with seasonal averages.

Gold price performance

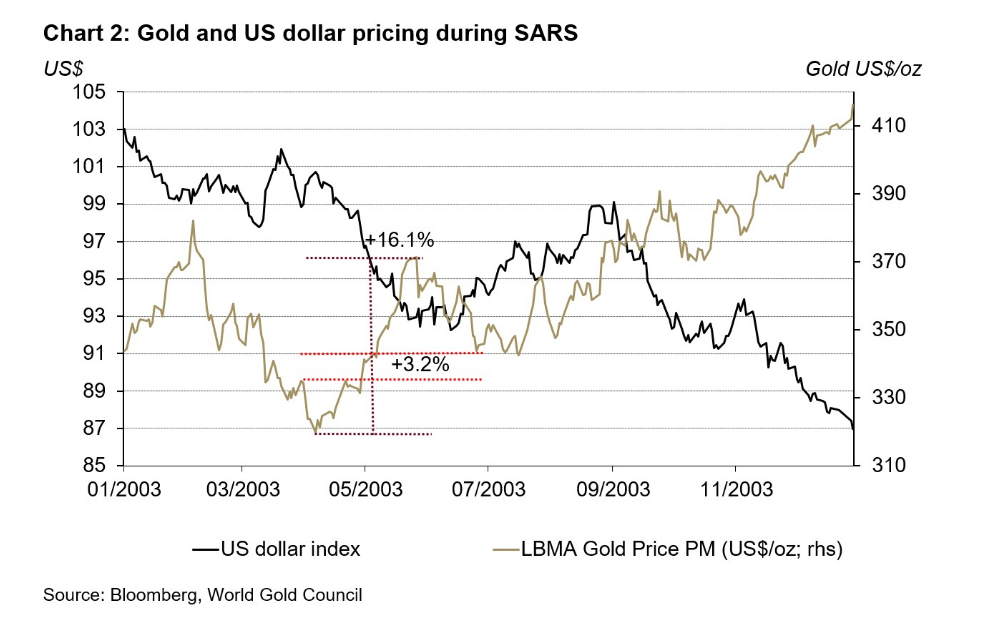

Our analysis shows that the impact on Chinese demand during SARS was fairly evident. However, its impact on price was not. The gold price increased by approximately 3% during Q2 2003 with an intra-quarter maximum of 16% (Chart 2). But it’s not easy to assess the contribution of SARS, if any, to gold’s performance, as the 2003 epidemic coincided with the start of the US invasion of Iraq and a period during which the US dollar generally weakened.

The evolution of China since SARS

While the comparison to SARS may provide some guidance, important changes have been experienced in China and the Chinese gold market since the 2003 outbreak.

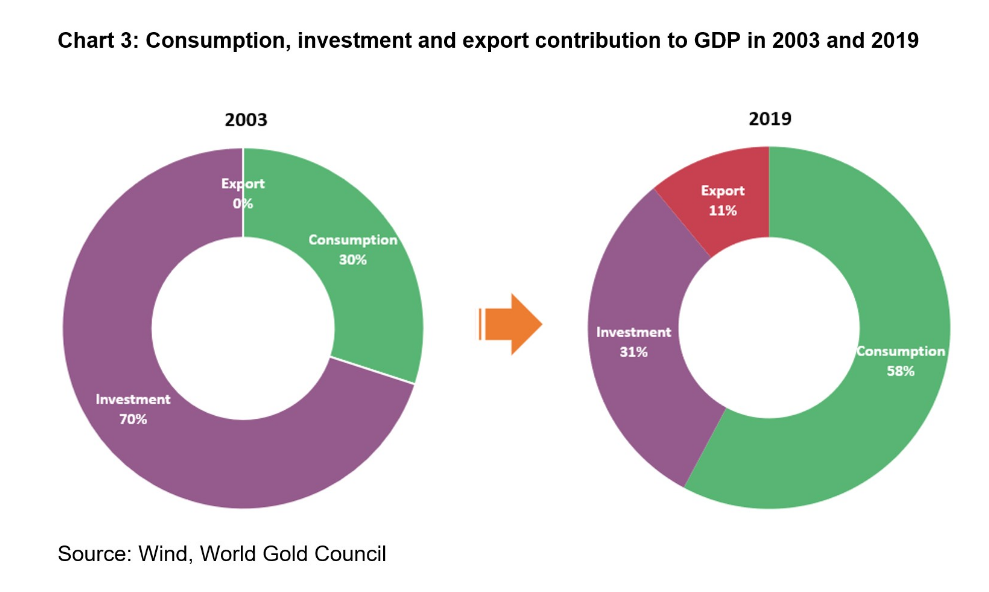

The Chinese economy in 2003 represented US$1.7trn compared to an estimated US$14.3trn in 2019.4 On a relative basis, China has become a more important component of the global economy, contributing close to 15% of world GDP today, relative to 3% back in 2003. In addition, the structure of Chinese GDP has markedly changed from being mostly investment driven to mostly consumption led (Chart 3).

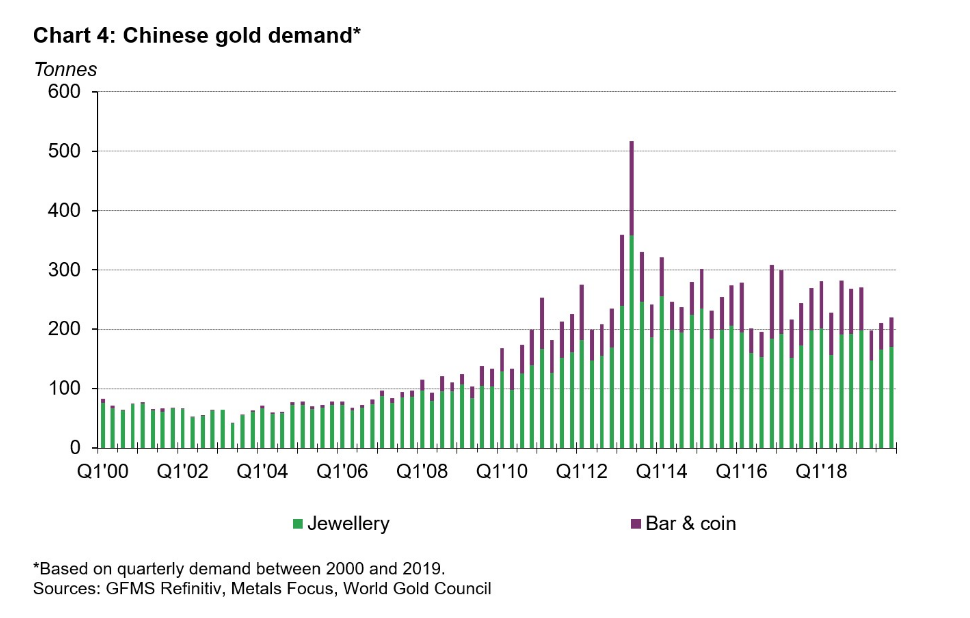

The Chinese gold market has also changed a lot. Chinese consumer demand accounted for 8% of the world’s total in 2003. Today, China is the largest gold market, contributing 30% of consumer demand in 2019. The sources of demand have also changed: investment was virtually nonexistent before the establishment of the Shanghai Gold Exchange (SGE) in 2002 and the legalisation of private gold investment in 2004 (Chart 4).

These changes to the size and makeup of the Chinese economy and the gold market have relevant implications on the likely effect of COVID19.

For example, the fact that Chinese GDP includes a higher contribution from consumption means that GDP may suffer more than it did in 2003 given the reduced economic activity it has already experienced so far this year. At the same time, the impact of softer Chinese growth will affect the global economy and increase investor uncertainty, which may support flight-to-quality flows into gold – in China and abroad. Some of this effect is already visible by the increase in trading volumes at the Shanghai Gold Exchange following the Chinese New Year, as well as by continued inflows into gold-backed ETF over the same period. On the other hand, however, the drag from a potential deceleration of Chinese gold consumer demand may have a more noticeable effect on price than it did in 2003.

Conclusion

The coronavirus outbreak in China is evolving rapidly. While expanded diagnostics have increased the number of reported cases, there are indications that the spread of disease is starting to decelerate, especially outside of Hubei Province, where the virus first struck. How it plays out is yet to be determined but, in our view, it is all but certain that China’s consumer demand will ease. Q1 demand may contract by at least 10-15% if history serves as a guide. Whether demand rebounds or continues to soften will depend on the duration of the epidemic and its impact on economic growth.

The impact on gold’s price performance is less clear:

If the situation is resolved relatively quickly and the global impact is contained, the outcome may be limited to softer Chinese gold demand and a transient impact on price

If the epidemic spreads further and continues to affect investor sentiment, global flight-to-quality flows, amidst concerns of a global deceleration, may have a more sustained (positive) impact on the gold price.

Footnotes

1 Center for Disease Control: https://www.cdc.gov/about/history/sars/timeline.htm

2 All outliers – marked with asterisks (“*”) – on Chart 1 correspond to 2013 demand when the gold price dropped substantially and demand did not follow historical seasonal patterns.

3 While we are not including bar and coin demand in the analysis below because the market was too small at the time, the limited data available still suggests a similar behaviour.

4 National Bureau of Statistics of China.