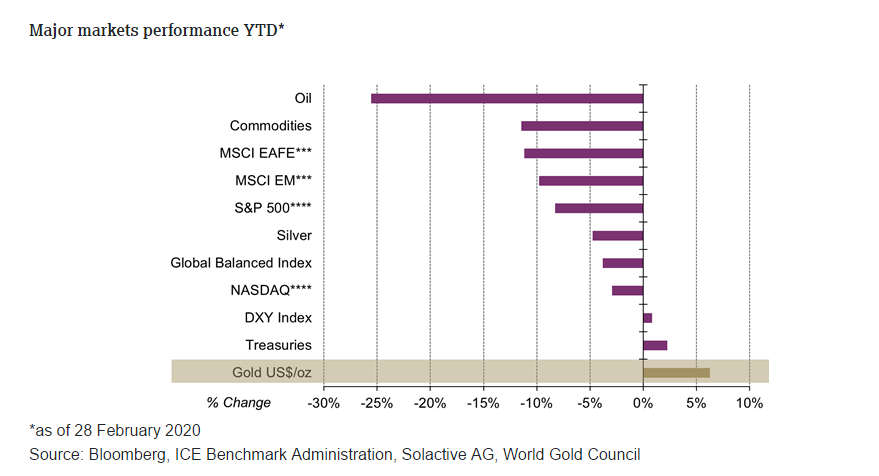

The stock market embraced the weakest one-week performance since the financial crisis last week on the back of growing concerns of the continued spread of the coronavirus across the globe. Despite the risk off-moves, gold was lower by more than 3% last week, which is historically unusual during these types of movements. There are a few potential reasons for the weakness.

First, gold is the strongest performing major asset class this year; the only one in positive territory at this point, up over 5%. This may have led to some profit taking

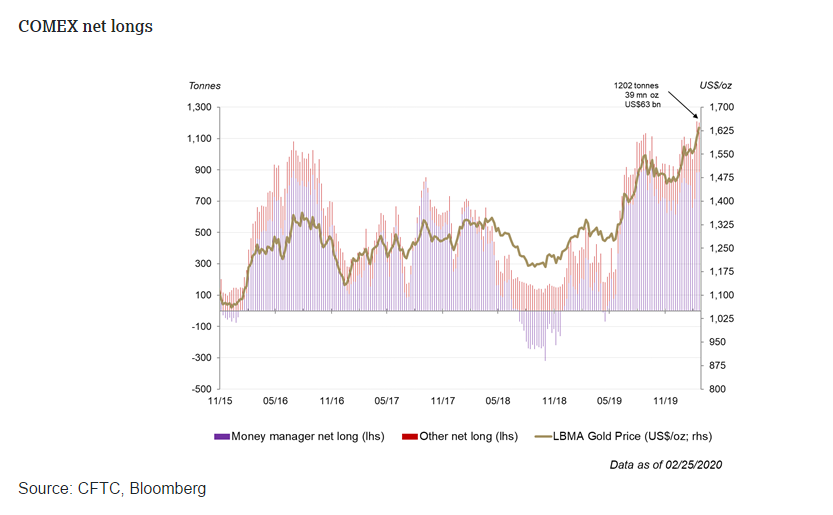

Along with profit taking, sentiment in the COMEX futures market via net longs was extremely bullish, at all-time highs of 1,209t. Extreme positioning, both bullish and bearish, can sometimes lead to reversals in price.

We often discuss gold as a source of liquidity in times of crisis. Prior to the move in the markets, leverage in risky assets like stocks were at lofty levels. The quick, sharp, sell-off could have caused margin calls, requiring liquidity sourcing from liquid assets like gold. Gold trading volumes, finished the month sharply higher, more than 20% above the 2019 average, at $180bn a day.

But there are shifts that could bode well for gold.

Investment demand for gold, particularly in the gold-backed ETF space remains strong. Last week there were inflows of over $1.5bn, and in February, global gold-backed ETF holdings grew 4% to new all-time highs. This was on the back on inflows in all-regions. We will release our February updated report on gold-backed ETF flows this Thursday.

We often discuss the opportunity cost of holding gold. Bond yields in the US, in particular the 10y and the 30y, have reached all-time lows. Overnight, the 10-yr touched the 1.0% level. As yields move lower, gold becomes more attractive from an opportunity cost perspective

As rates have fallen sharply, the probability of Federal Reserve cuts moved to expectations of 3.5 cuts in 2020, with a 100% predicted cut of 50bps at the March meeting. As noted, gold tends to outperform during periods of Fed easing.

Technically, Gold remains in a bullish uptrend, despite last week’s pullback, and could continue higher as long as it holds the 50-day moving average of approximately $1,562/oz.

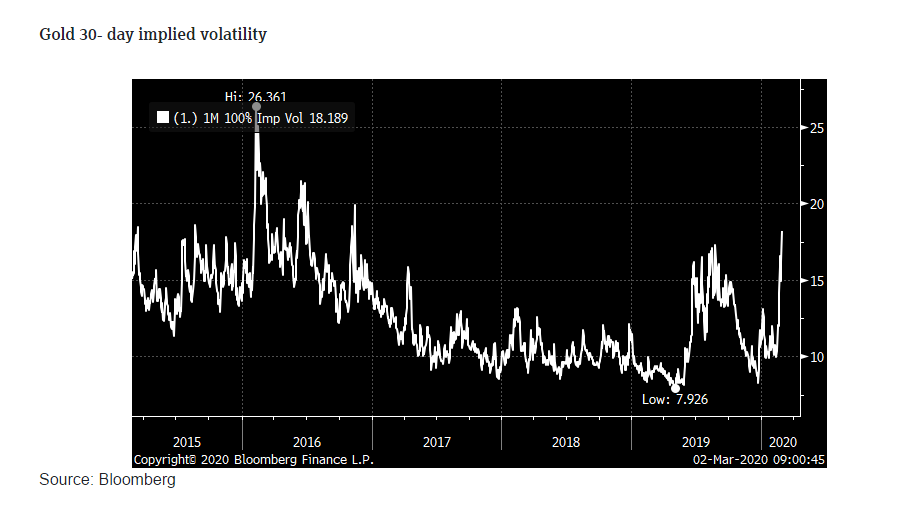

Finally, as we noted in the 2020 Gold Outlook, our suggested drivers of gold remain. Market uncertainty, weakening global economic growth, and gold price volatility are likely to drive the market. As shown below, we already started to see a large increase in short-dated implied volatility of gold, where the levels reached those last seen in 2016.