This week, we launched our February 2020 ETF flows report, which highlights the positive impact current market volatility is having on investment flows in gold-backed ETFs.

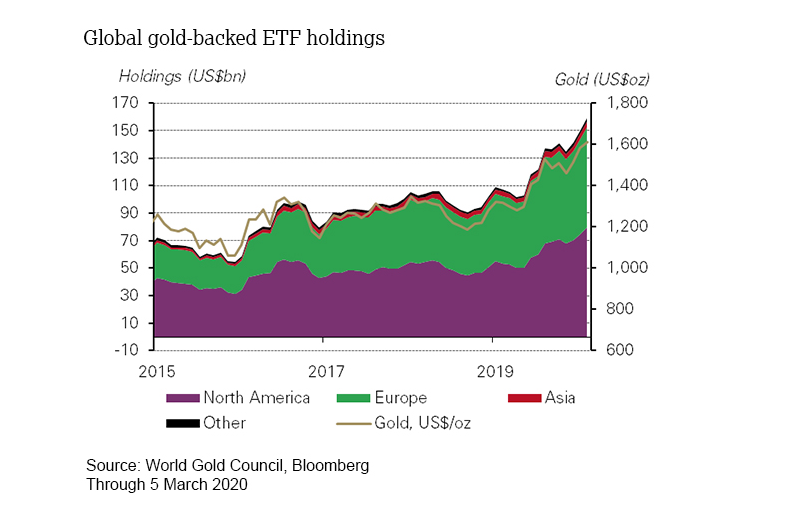

Inflows across all regions of nearly US$5bn during February (84.5 tonnes), boosted total gold ETF growth to 5% over the first two months of the year. Gold ETF assets values have grown 50% over the past twelve months as holdings continued to reach new highs of 3,033 tonnes, or US$153bn.

This trend has continued in the first week of March as gold moved higher. Through the first four trading days of March, global gold ETFs have added and additional US$2.3bn or 1.4%.

In the report, we note some of the drivers including:

Market uncertainty, volatility and the economic impact of the coronavirus

Lower interest rates and Fed easing

Gold price outperformance, compared to other major asset classes

Bullish investment positioning in the golf futures markets, and

Gold separating itself from other commodities